Swiss watchmaking, (value) world number one

In 2012, the number of finished watches exported by Switzerland reached 2.92 million, a decrease of 2.2% in one year. The world finished product table annual output of 1.2 billion, the above data only accounted for 2.5%. In other words, it is not worth mentioning in terms of quantity. China dominates and becomes the largest exporter of finished products in the world with an export volume of 663 million in 2012. Followed by Hong Kong, exports 354 million. And Switzerland can only third place. The situation is quite different when ranked from a value perspective: Switzerland is number one, with 95% of watches priced at more than 1,000 Swiss francs all from Switzerland. It is noteworthy that in 2012 the average Swiss watch price of 739 US dollars (688 US dollars in 2011), while the Chinese-made watches, the average price of only 3 US dollars.

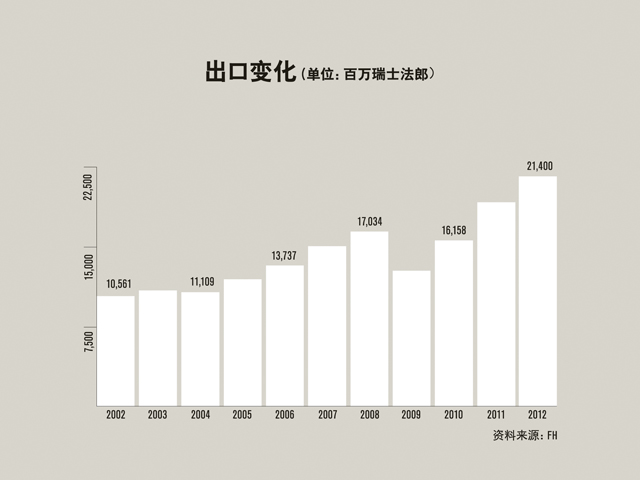

Swiss watchmaker exports a new record

Swiss watchmaking industry in the world without exception. This assessment seems trivial, but inevitable. If people are familiar with the annual export data of Swiss watchmaking in recent years, it is not surprising. In 2012, Swiss watchmaking exports amounted to 21.6 billion Swiss francs, an increase of 10.9% over 2011. In 2011, the Swiss watch industry exported 19.3 billion Swiss francs (up 19.2% in the same year). Despite the good times and bad times in the global economy, the following facts are undeniable: Swiss watch export data shows that the industry is in good condition and broke the record for two consecutive years. It is expected to grow steadily in 2013, but the speed will definitely slow down. In view of the 19.2% growth rate in 2011 and the 10.9% growth rate in 2012, the growth rate is on a downward trend.

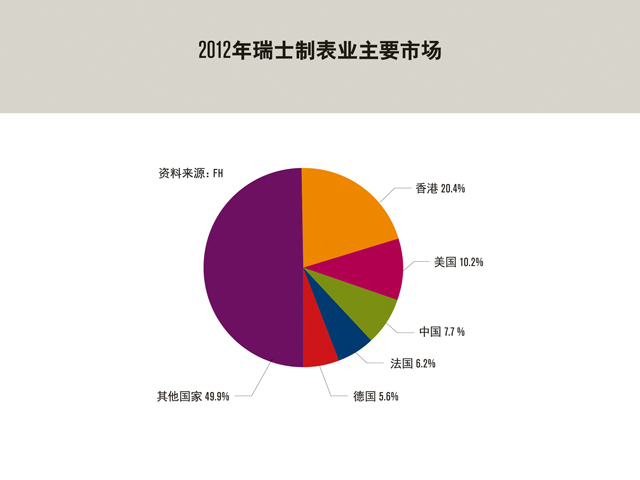

Who is the purchaser of a Swiss watch?

In 2012, the export volume of all exporting countries and regions hit a new high. The highest annual growth rate in Europe (up to 16.3%), exports amounted to 6.5 billion Swiss francs. The "Old World", while absorbing 30% of Swiss watchmaking exports, also occupies part of the Asian market (absorbing 54% of exports) and exports amounting to 11.6 billion Swiss francs. In exporting countries and regions, Hong Kong took the lead, playing the role of Asia's commercial springboard, buying 20.4% of Swiss watches (worth 4.4 billion Swiss francs). The United States (10.2%, 2.2 billion Swiss francs) and China (7.7%, 1.6 billion Swiss francs) followed, with China becoming the third largest buyer of Swiss watches for two consecutive years. In Europe, the Swiss watch purchases in Germany amounted to 1.2 billion Swiss francs, up 33.1% in the same year, ranking fifth.

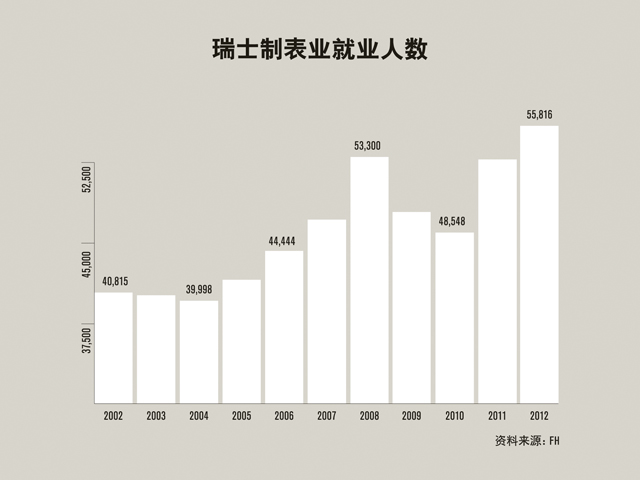

An industry that offers more jobs

In Switzerland, there are currently 56,000 employees in watchmaking and micro-technology industries, an increase of 5.7% from a year earlier, the highest in 35 years. In 1975, the beginning of the watch industry crisis, the number of employed workers in the industry was higher than the number of employed workers in 2012 (55,816). Since 2010, the number of employed people has increased by 7,268 (a 15% increase). And we still remember the 4,800 jobs that were canceled in late 2008 and early 2010. The most labor-intensive counties in the watch industry are Neuchatel (15,323), Berne (11,184) and Geneva (9,358). In addition, the ratio of highly qualified employees also made the watchmaking industry booming: 62.9% (61.5% in 2011) of employers with a craft diploma or higher education, accounting for two-thirds of the total number of employees, and 20 years Before, only one-third.

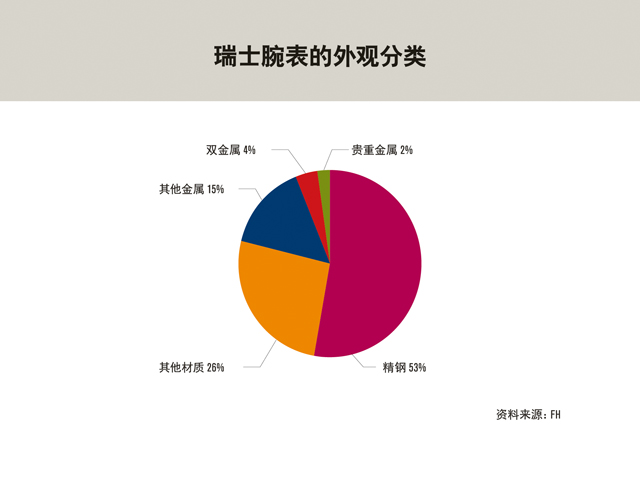

"Made in Switzerland" (MADE IN SWITZERLAND) the main material of the watch

Gold is the highest price increase in 2012 material. The value of gold and steel gains soaring. Of the total export value of 21.4 billion Swiss francs, gold watches increased by 20.5% to 7.3 billion Swiss francs, while stainless steel watches rose 8.2% to 7.6 billion Swiss francs. In addition, bimetallic (gold and steel) watch exports amounted to 3.3 billion (up 5.3%). In terms of quantity, stainless steel watches account for 53%, while other precious metals account for only 2%.

Swiss official Observatory Table Certification Authority official certification of the Big Three

The COSC-Contrôle officiel suisse des chronomètres, a high-end watchmaking body, is an independent body dedicated to the precise testing of movements equipped with second-order displays and issuing certificates based on test results. After several days of testing the watch at different positions and temperatures, the Swiss Astronomical Observatory Test Authority determines whether or not to grant a "Astronomical Table" certificate to it (Do not confuse chronographs and timers measuring short durations ). The Swiss official Observatory Table Testing Authority is responsible for the testing and certification of mechanical and quartz movements. In 2012, more than fifty watchmakers or movement makers sent their movements to the Swiss official observatory's watch testing office for testing. A total of 1.73 million movements won this award, is also considered a record. Over the years, the three giants of this tabulation have remained unchanged: Rolex topped the list, and in 2012 a total of 798,935 movements were certified. Omega followed closely, with 526,046 certified movements and the third in the list with 156,773 certified movements, including 35,448 quartz movements.

Global watchmaking empire

Swatch Group, Richemont Group and Rolex for 45.8% of the global market share. Compared with 2011, the three giants have taken a share of other market participants. At the fourth place is Fossil (USA), which replaced the LVMH LVMH Group, which was among the best in the industry for the acquisition of Bulgari, the Italian watchmaking and jewelry brand, the year before. Japan's watchmaking giant (Citizen, Seiko and Casio) accounted for only 9.4% of the total market, or even less than the share of Rolex.

The most valuable Swiss brand

According to the "Best Swiss Brands 2013" (Best Swiss Brands 2013) report from Interbrand, a total of 16 watch brands are among the top 50 Swiss companies. And two of them topped the top ten! Top ten watch brands, without incident, that is, Rolex and Omega. The Rolex brand, valued at 6.6 billion Swiss francs, finished in fifth place with the top four being Nescafé, Roche, Novartis and Nestlé. Omega brand valuation of 3.3 billion Swiss francs, ranking tenth. Interbrand's assessment is clear: "Switzerland has long been the cradle of well-known brands that have unparalleled quality, reliability and innovation in a country characterized by a diverse and compelling innovation capability." According to the brand's financial stability , The important role played in acquisition decisions, and the competitive advantage to evaluate and calculate the brand. The research institute also said: "Thanks to its unique and prominent reputation, the Swiss watchmaking industry is able to generate substantial profits in the face of the growing demand for luxury goods in the world." This rating will enable Swiss watch brands to introduce new products Confident.

Source: Swiss Watch Industry Association (FH), Swiss Watchmaking Employers Federation (CP), Vontobel Luxury / Watch Industry (March and May 2013 luxury stores) study, Swiss Official Observatory Table Certification Authority ( COSC-Contrôle officiel suisse des chromonètres), Interbrand (best Swiss brand of 2013).